My Latest Posts

Why Now Could Be a Smart Time to Move: Mortgage Rates, Home Prices & End-of-Year Buying Opportunities

1. The Big Picture: Rates and Prices Moving in a Favorable Direction

According to the latest research from Fannie Mae, the outlook for mortgage rates and home-prices has improved meaningfully. Their recent forecast shows that mortgage rates are expected to end 2025 at around 6.3 %, and by 2026 drop further to roughly 5.9 %.

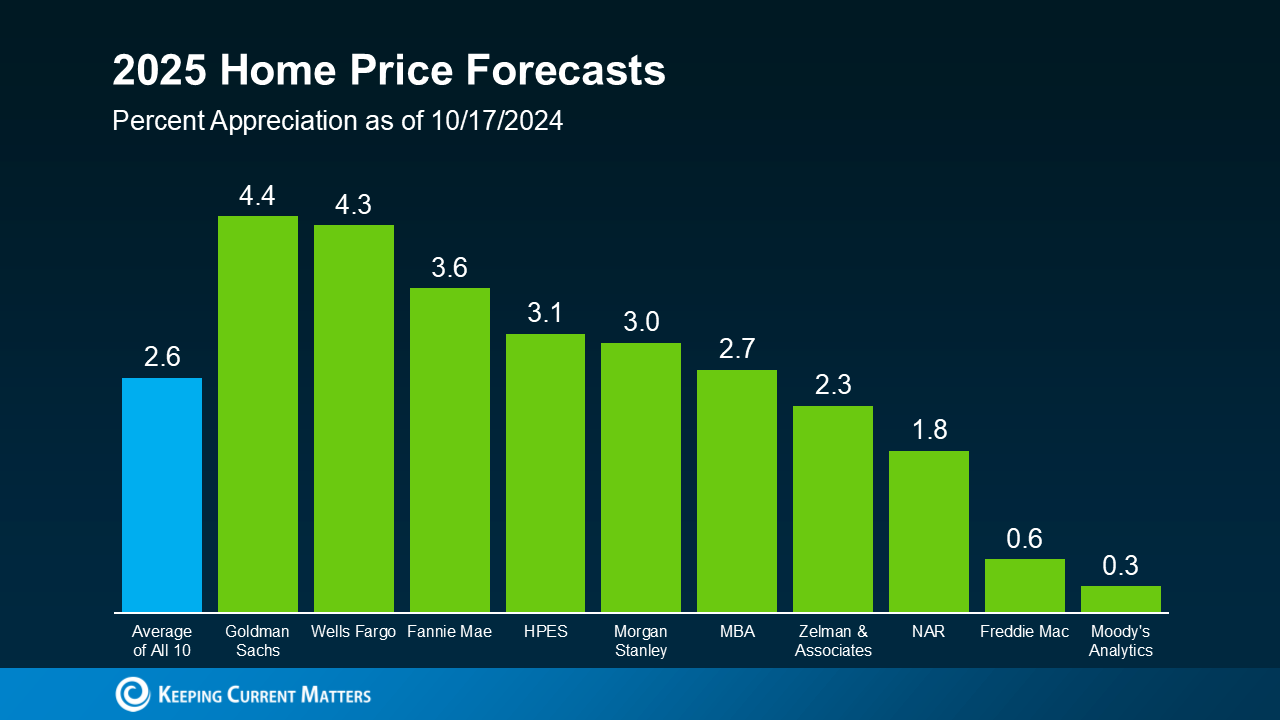

Likewise, home-price growth is moderating — meaning buyers may face less steep upward pressure on purchase price.

For you as a mortgage professional, this creates a narrative of “improving affordability” and “window of opportunity” that you can communicate to both agents and prospective buyers.

2. Why This Matters for Borrowers & Agents

For Borrowers:

With rates expected to gradually ease, buyers might be able to lock in a more favorable payment now or in the near future.

Moderating price growth can help with affordability — even if rates remain above historic lows, the combination can improve buying power.

If you act now, you can position clients to benefit from the tail end of the year’s tax advantages (more on that in Section 4).

For Real Estate Agents:

Make this an angle: “Rates in flux → buyer window opening.” Use it to re-energize clients who parked their search because of high rates.

Work collaboratively: Mortgage lenders (you) + agents = helping clients act before end-of-year dynamics kick in.

Lead generation: Reach out to past “almost-buyers” or first-time buyers who were waiting; this is the hook.

3. What’s Going On at the Fed & in the Economy?

While the Fed is not a direct mortgage-rate setter, its policy actions and economic data influence market rates. According to Mortgage Professional America, despite a data blackout caused by the government shutdown, the consensus is that more rate cuts by Federal Reserve are likely.

Here’s what to highlight:

The “data blackout” means less clarity on economic metrics (like employment, inflation). That uncertainty can make markets cautious — but it also boosts hope for future easing.

The expectation of more Fed cuts tends to generate downward pressure on long‐term yields, which indirectly helps mortgage rates.

Market watchers are looking at the “psychological thresholds” of mortgage rates: even a small permitted drop (say from ~6.5 % to ~6.3 %) could spark greater demand.

For you, this means you have a timely message: “While we’re waiting on every data point, the directional bias is favorable for buyers — let’s get them ready.”

4. The End-of-Year Homebuying Advantage

One of the most compelling pieces for your blog is the advantage of buying a home before the calendar year closes. According to Realtor .com:

Buyers who close by December 31 can access tax deductions (mortgage interest, property taxes, points) for the year. Fall and early winter often bring lower competition and more motivated sellers (because they want to close before year-end) which can translate into better deal terms.

For agents, this creates a sense of urgency: “Let’s prep now, so we’re closing in Q4 and capturing those benefits.”

Actionable items for your clients:

Get pre-approved now (so you’re ready).

Align with an agent who can identify motivated listings.

Negotiate closing schedules and explore tax implications with a CPA or tax advisor.

Don’t assume you must wait for “rates to drop dramatically”; the combination of decent rate + closing before year end ≠ waiting indefinitely.

5. Closing Thoughts

In summary: The conditions are aligning for a potential window of opportunity for homebuyers — lower (or improving) mortgage-rate outlooks, moderating home-price growth, and strong fiscal/tax advantages for year-end closings. For borrower-clients and real-estate-agent partners, now is the time to act, not just wait.

If you’re a real estate agent partner: Let’s talk this week about how we can collaborate to tap into this momentum.

If you’re a borrower: Let’s get you pre-approved, review your buying budget, lock in your strategy — and aim to capitalize before the year turns.

Want to go deeper? Reach out to me at Funding USA and let’s schedule a strategy call.

References:

Fannie Mae: Mortgage Rate & Home Price Forecasts

Mortgage Professional America: Fed preview + data blackout

Realtor.com: Buying a home before year-end advantages